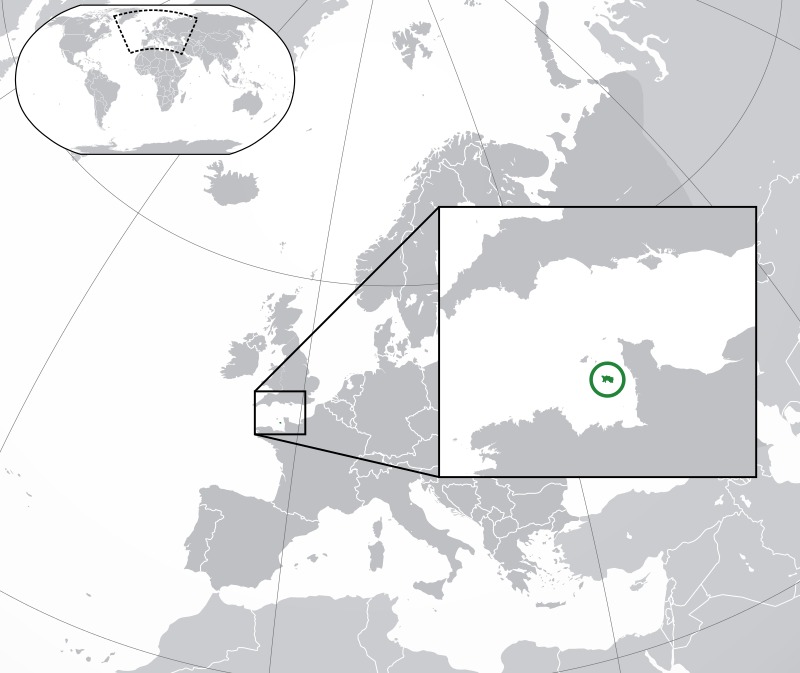

Jersey, officially the Bailiwick of Jersey is an island and self-governing British Crown Dependency near the coast of north-west France. It is the largest of the Channel Islands and is 22 kilometres (14 mi) from the Cotentin peninsula in Normandy. The Bailiwick consists of the main island of Jersey and some surrounding uninhabited islands and rocks.

Sovereign state United Kingdom

Crown dependency Bailiwick of Jersey

Separation from the Duchy of Normandy 1204

Capital and largest parish Saint Helier

Official languages English, Jèrriais and French

Common languages Portuguese and Polish

Ethnic groups (2011)

46.4% Jersey

32.7% British

8.2% Portuguese

3.3% Polish

2.4% Irish

0.9% French

3.8% Other European

1.3% Asian

0.4% African

0.7% multiracial

Religion (2015)

39% non-religious

23% Anglican

22% Catholic

7% Other Christian

2% Other religion

Population

2019 estimate 107,800[5] (196th)

Density 912/km2 (2,362.1/sq mi)

Jersey, British crown dependency and island, the largest and southernmost of the Channel Islands, lying south of England’s coast and 12 miles (19 km) west of the Cotentin peninsula of France. Its capital, St. Helier, is 100 miles (160 km) south of Weymouth, England. Jersey is about 10 miles (16 km) across and 5 miles (8 km) from north to south. The Ecrehous rocks (6 miles northeast) and Les Minquiers (12 miles [19 km] south) are in the Bailiwick of Jersey.

The economy of Jersey is a highly developed social market economy. It is largely driven by international financial services and legal services, which accounted for 39.5% of total GVA in 2019, a 4% increase on 2018. Jersey is considered to be an offshore financial centre. Jersey has the preconditions to be a microstate, but it is a self-governing Crown dependency of the UK. It is considered to be a corporate tax haven by many organisations.

Other sectors include construction, retail, agriculture, tourism and telecommunications. Before the Second World War, Jersey's economy was dominated by agriculture, however after liberation, tourism to the island became popular. More recently, the finance industry recognised worth in operating in Jersey, which has now become the island's dominant industry.

In 2017, Jersey's GDP per capita was one of the highest in the world at $55,324. In 2019, the island's economy, as measured by GVA, grew by 2.1% in real terms to £4.97 billion. In December 2020, there were 1,350 people actively seeking work.

Tourist Information Centre

St. Helier

https://www.jersey.com/see-and-do/tourist-information-centre

About

The team at the Tourist Information Centre are looking forward to giving you a warm welcome and sharing our little island’s big spirit with you once again. You will find things are a little different on the island now, quieter and safer. We’ve put new measures in place that ensure the health and well-being of you, your loved ones, and our local community. So come to Jersey, refresh, revitalise and reconnect with nature. Come up for air again. We’re waiting for you.

Telephone 01534 859000

Email info@jersey.com

Travelling to Jersey

https://www.jerseytravel.com/travelling-to-jersey

Contact Us

JerseyTravel.com

Heron House, Jersey Airport, Jersey, United Kingdom JE1 1BW

Phone: 01534 496 650

Routes to Jersey

Experience sea, sand and a short flight time because never being more than 10 minutes from a beach isn't Jersey's only convenience...

Travelling by air to Jersey

Book your Jersey Holiday by air or sea from many UK locations. Flights operate all year from large international hubs such as London Gatwick, Manchester, Glasgow and Birmingham, as well as smaller airports including Liverpool, Southampton, Bristol and Exeter in as little as 45 minutes flying time.

During the summer months regular flights are in operation from a handy selection of regional airports, offering convenient travel for customers living near London Stansted, Teesside, Humberside & Belfast.

Travelling by sea to Jersey

Jersey visitors can also take advantage of regular sea links, with fast ferries departing from Poole and Guernsey throughout the year with the option of travelling with your own car or as a foot passenger. During the summer months, ferries depart every day which makes travel not only convenient but fast with a journey time from Poole of only 4 hours.

As Jersey is part of the British Isles, you won't have to change your currency or bring a passport, just bring a standard form of photo ID and you’ll be on the beach in no time!

Tax Haven Information

Government spending and economic management

Taxation

Jersey does not have inheritance, wealth, corporate or capital gains tax. Jersey is considered to be a tax haven by a number of organisations. Jersey does not feature, however, in the March 2019 revised EU list of non-cooperative jurisdictions for tax purposes. The chair of the EU Tax Matters Subcommittee Paul Tang has criticised the list for not including "renowned tax havens" such as Jersey.

In 2020, Tax Justice ranked Jersey as the 16th on the Financial Secrecy Index, below larger countries such as the UK, however still placing at the lower end of the 'extreme danger zone' for offshore secrecy'. The island accounts of 0.46 per cent of the global offshore finance market, making a small player in the total market.

St Helier Waterfront, Jersey, Channel Islands, UK

Personal Tax

Until the 20th century, the States relied on indirect taxation to finance the administration of Jersey. The levying of impôts (duties) different from those of the United Kingdom was granted by Charles II and remained in the hands of the Assembly of Governor, Bailiff and Jurats until 1921 when that body's tax raising powers were transferred to the Assembly of the States, leaving the Assembly of Governor, Bailiff and Jurats to serve simply as licensing bench for the sale of alcohol (this fiscal reform also stripped the Lieutenant-Governor of most of his effective remaining administrative functions).

The first income tax in Jersey was introduced in 1928. Income tax has been levied at a flat rate of 20% set by the occupying Germans during the Second World War. Jersey's tax is not entirely regressive, however. Exemption thresholds apply to those on lower incomes and tax reliefs exist for married couples, single parents, child day care and children. Residents living in Jersey under the high value residency scheme are charged 20% on the first £725,000 and 1% on anything over that amount.

Until February 2020, married women in Jersey did not have control over their own tax affairs. Since 1928, married couples were required to file tax receipts under their spouse's name, married women's earning were considered part of their spouses' earnings and male permission was required for women to be treated separately or to discuss her financial affairs with the tax office. For couples in same-sex marriages, the older partner was required to give permission for the younger. In 2020, a vote in the States Assembly (40 pour, 2 abstentions) to reform the law to give both marriage partners equal rights over the couple's tax affairs passed to come into force from 2021.

Goods and services tax

Historically, no value added tax (VAT) was levied in Jersey, with the result that luxury goods have often been cheaper than in the UK or in France. This provided an incentive for tourism from neighbouring countries.

The States of Jersey introduced a goods and services tax (GST) in 2008. It was originally set at 3%, but rose to 5% on 1 June 2011 as part of the 2011 States budget. To try to prevent islanders living below the poverty line, the States of Jersey introduced an Income Support service in January 2008.

Although this is a form of VAT, there are a number of significant differences between the European VAT and Jersey's GST. It is charged at a much lower rate than UK or French VAT, so Jersey can still act as a low-tax shopping jurisdiction on certain items, however there are much fewer exemptions to GST policy. For example, no VAT is charged on female sanitary products (the so-called 'tampon tax') in the UK while GST still applies in Jersey.

VAT tax avoidance

The absence of VAT also led to the growth of a fulfilment industry, whereby low-value luxury items, such as videos, lingerie and contact lenses are exported in a manner avoiding VAT on arrival, thus undercutting local prices on the same products. A number of companies, including off-island companies Tesco, HMV and Amazon and on-island companies Play.com and Blahdvd, operated this model.

In 2005 the States of Jersey announced limits on licences granted to non-resident companies trading in this way. Low-value consignment relief provided the mechanism for VAT-free imports from the Channel Islands to the UK. In April 2012, the UK closed this loophole, leading to the closure of many island businesses and the loss of a number of jobs on the island.

The Social Security department introduced a Back to Work programme to deal with the job losses and Jersey Post had to suffer significant cut-backs in response to a reduction in fulfilment. The States appealed against the UK decision, but this failed. As a result of the new rule, the UK tax authorities reported a 200% rise in import VAT from the Channel Islands, estimated at £95 million per year.

Coroporation Tax

Jersey has a corporate income tax. The standard rate for all corporations is 0%, however Jersey is not a corporate-tax free jurisdiction. A 10% tax applies for regulated financial services companies and a 20% maximum tax rate applies for larger corporate retailers and utility and property income companies.

It is arguable that the people who benefit from Jersey's new tax structure are the owners of the large businesses that are separate or support the financial service based businesses. This is because they do not have to pay any corporation tax but will still benefit from the island's business.

In 2020, the Corporate Tax Heaven Index ranked Jersey 8th for 2021 with a haven score (a measure of the jurisdictions’ systems to be used for corporate tax abuse) of 100 out of 100, however only has 0.51% on the Global Scale Weight ranking.

Welfare state

During the COVID-19 pandemic, the government introduced Co-Funded Payroll to support businesses.

Financial services in Jersey

International Finance Centre

Jersey-based financial organisations provide services to customers worldwide. In June 2020, it was reported that there were 13,450 jobs within this sector. The finance sector profits were about £1.18 billion in 2015.

Jersey is one of the top worldwide offshore financial centres It has been criticised for its tax practices, with many calling the island a tax haven.[36] It attracts deposits from customers outside of the island, seeking the advantages such places offer, like reduced tax burdens. In 2020, Tax Justice ranked Jersey as the 16th on the Financial Secrecy Index, below larger countries such as the UK, however still placing at the lower end of the 'extreme danger zone' for offshore secrecy'. The island accounts of 0.46 per cent of the global offshore finance market, making a small player in the total market.

In the second quarter of 2020, the total value of banking deposits held in Jersey decreased from £145.7bn to £141.2bn. There were 33,186 live companies on Jersey's register.

Jersey shares The International Stock Exchange (TISE) with Guernsey, where it is based.

Location of Jersey (green) in Europe (dark grey)

Satellite view of Jersey

Mont Orgueil was built in the 13th century after its split from Normandy

A statue of Jersey golfer, Harry Vardon, stands at the entrance to the Royal Jersey Golf Club

Jersey Flag

Jersey Coat of Arms

News article

Jersey lures China businesses in its role as an international finance centre

http://www.chinadaily.com.cn/world/2015-07/14/content_21271257.htm